by F. Milene Henley

San Juan County Auditor

It is the best of times, it is the worst of times; it is the season of light, it is the season of darkness; it is the spring of hope, it is the winter of despair.

Out of respect for Charles Dickens, I’ll stop there. But truly, we live in extraordinary times, in which an energized economy is producing income and jobs, while that very growth is making it more expensive and more difficult for our citizens to live and work here. A lack of affordable housing, threats to medical insurance, and long-deferred increases in interest rates and other cost inflators are driving living costs to untenable heights for many of our residents.

Speaking strictly of local government, our love affair with sales tax continues. We have enjoyed 8 to 12 percent annual increases in sales tax revenue to the county the last three years, and 2017 looks so far as if it will continue that trend. Lodging taxes are a subset of sales tax, and have been growing even faster than general sales tax – something you might have guessed, judging by the traffic, the parking, and the ferry overloads we’ve been experiencing this summer.

Building and planning revenues are also exceeding budget, as are miscellaneous revenues, which is mostly interest. Another revenue source that is performing exceptionally well – though there are restrictions on how we can use it – is real estate excise tax, which is essentially a sales tax on real property.

The flip side of all this prosperity is the very real, and increasing, problem that people cannot afford to live here. Housing is in critically short supply, with many full-time employed workers living, not by choice, on boats, in tents, and in the homes of family and friends, waiting and hoping that they will soon find a place they can afford. Both interest rates and real estate prices have finally started to move upwards, keeping home ownership an impractical solution, for most people, to the lack of rentals.

On another front, national threats to medical insurance are exacerbated by local threats to medical services. Lopez has already formed, and Orcas may soon form, a hospital district in order to keep their local clinics afloat. While such measures preserve local services, they do so at the cost of higher property taxes.

This double-edged economic environment prompts the question: is the economy growing faster than the costs of living? Is this the best of times? Or is it the worst?

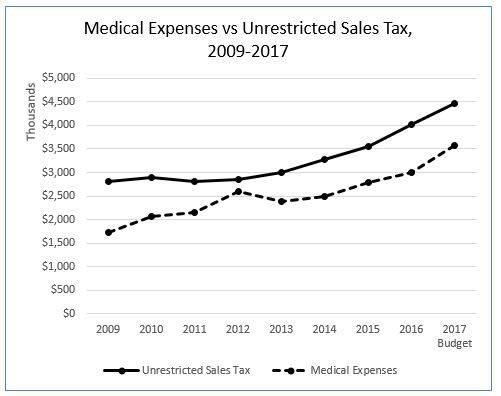

To visualize the question, I graphed the county’s unrestricted sales tax revenue against the County’s cost for medical insurance, including dental insurance and HSA (Health Savings Accounts) contributions. Both have grown substantially in the past eight years. Sales tax is higher – that is, we bring in more in unrestricted sales tax revenue than we pay out for medical insurance – but the growth trends are similar. Sales tax has grown more steadily, following a recession-related decline. Medical costs have grown more erratically, with a marked drop in 2013, when the County changed medical plans in order to save money. Despite the change, medical insurance costs have grown 107% from 2009 to 2017, compared to 59% for sales tax. As a result, the gap between the two has lessened – from about $1.1 million to about $.9 million. Medical costs used to equal 61% of local option sales tax; they are now 79%. If these trends continue, it won’t be long before the county’s local option sales tax – its only unrestricted sales tax revenue – is paying for nothing but medical insurance for its employees.

Dickens had it right. The present period, for good or for evil, is spoken of in the superlative degree of comparison only, with good reason. Let’s hope that we can work together as a community – just as Lopez Island is doing, with its hospital district – to find solutions; and that a far, far better future awaits us.